A Deep Dive for the Risk-and-Volatility-Ready Family Office

1. What is LCAP?

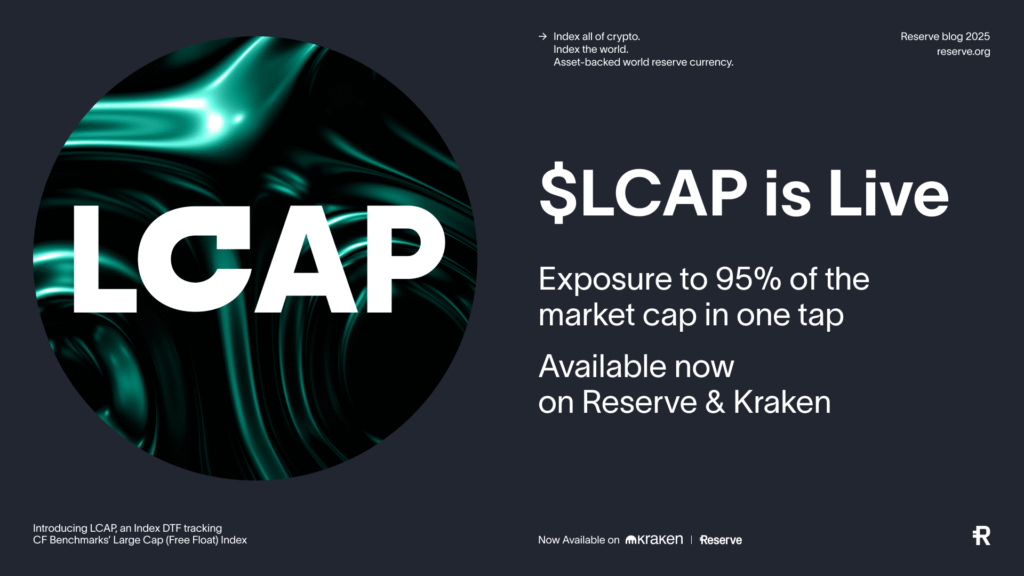

LCAP is an on-chain index token created by Reserve Protocol in collaboration with CF Benchmarks, designed to replicate the performance of the large-cap crypto market via a single token.

Key features:

- It tracks the “Large Cap” segment of the crypto market — roughly the top 10 crypto assets by market capitalization.

- It is fully backed (1:1) by the underlying assets in smart contracts — not a synthetic derivative.

- It has quarterly rebalancing to maintain index alignment.

- It is listed and tradable on Kraken, available to buy directly on the Kraken spot market (ticker LCAP/USD, LCAP/EUR, and LCAP/USDT).

- LCAP can also be accessed through Reserve’s own dApp interface for on-chain exposure and wallet-based custody.

In short: instead of buying BTC, ETH, XRP, SOL, ADA, and others individually (and rebalancing manually), you can buy one token — LCAP — to gain diversified exposure to most of the major crypto market cap in a single trade.d rebalancing), you can buy one token (LCAP) that gives you diversified exposure to most of the major crypto market cap via one instrument.

2. Why It’s Interesting for a Volatility-Friendly Family Office

At Third State, where we favor volatility, macro structural themes, and high-conviction risk assets, LCAP presents several appealing angles:

- Diversified Exposure – The one-token structure reduces the concentration risk of picking a single coin while maintaining access to the major crypto cap3 movers.

- Simplified Execution – Less “coin-choosing” overhead; instead of managing 8-10 coins, you manage one position.

- ETF-Like Behavior in Crypto Form – LCAP brings index-based logic (like in traditional equities) into crypto, bridging institutional adoption potential.

- 24/7 Digital Native Market – Being blockchain native, trading happens around the clock; for a volatility-seeking investor that means more opportunities.

- Liquidity via Kraken – Listing on Kraken means better execution, deeper liquidity, and institutional-grade infrastructure backing the trade.

3. Mechanics & Structure

- Underlying Index: The CF Large Cap (Diversified Weight) Index by CF Benchmarks.

- Coverage: Roughly the top-10 large cap cryptos, accounting for ~90% of the crypto market cap.

- Backing: Each LCAP token is backed by actual assets held in smart contracts (not just a promise).

- Rebalance Frequency: Quarterly — ensures the basket remains aligned with the cap-weighted universe.

- Trading: Available on Kraken, meaning you can buy/sell it in a familiar exchange environment.

4. General Outlook: What to Expect

Short-Term (H2 2025):

- Expect fluctuations: As crypto markets swing, LCAP will inherit the volatility of the underlying basket.

- If large-cap crypto moves up (e.g., Bitcoin/Ethereum rally), LCAP should capture much of that upside.

- Liquidity/market-structure risks still are non-trivial: watch spreads, depth, and slippage around major moves.

Medium-Term (2026+):

- If crypto adoption expands, large caps continue to dominate and structural flows move in (ETFs, institutional index adoption), then LCAP could be a strong proxy for the crypto market’s “core” orientation.

- Conversely, if alt-coins or small caps dramatically outperform, then LCAP might lag (since it is weighted toward the big names).

- Regulatory/market infrastructure maturation will matter: as the token crosses into more institutional view, it could benefit from “productization” (i.e., seen as a “crypto large-cap index” instrument).

5. Risks & Considerations

- Smart contract/backing risk – Although backed, any issues with the on-chain contracts or asset custody could pose risk.

- Tracking error – Though designed to replicate the basket, slippage, liquidity events or underlying asset shocks could produce divergence.

- Underlying concentration – Large caps like BTC/ETH may dominate performance; if they falter, the basket may suffer.

- Regulatory & tax risk – Crypto asset regulation remains evolving; how LCAP is treated may vary by jurisdiction.

- Liquidity shock – In a sharp crypto market move, liquidity in LCAP may suffer, widening bid-ask spreads or causing slippage.

- Market regime risk – If small/mid-cap cryptos outperform or there’s structural rotation away from big-cap crypto, LCAP may lag alternative strategies.

6. Execution Strategy for Third State

Given our appetite for volatility and thematic conviction, we’d propose the following positioning with LCAP:

- Allocate a core crypto “index” position via LCAP: This gives macro-wide crypto exposure without the idiosyncratic coin-picking risk.

- Layer in satellite positions in more aggressive/free-beta alt-coins for the extra upside.

- Set stop-loss/hedge reference levels: Because large-cap crypto still swings, define a risk threshold for this allocation.

- Monitor rebalance events and index composition changes: Periodic rebalancing means composition may shift; ensure you’re comfortable with the underlying exposures.

- Use Kraken’s platform features: Since LCAP is listed on Kraken, exploit their liquidity, trading pairs, alerts and execution tech to manage your position actively.

7. Final Thoughts

LCAP represents an elegant bridge between the familiar logic of indexed investing and the emerging frontier of crypto. For a family-office investor like Third State — focused on volatility, structural themes and asymmetric payoff – LCAP offers a compelling tool: diversified large-cap crypto exposure in a single token, tradable on a reputable exchange.

However, as with all crypto exposures, success will depend on execution discipline, risk-management, and ongoing monitoring of both market fundamentals and product mechanics. LCAP could form the core of the crypto sleeve in your portfolio, while the more speculative “high‐ beta” plays remain in satellite positions.

Leave a Reply